Why 85% of LPs Are Rejecting Your Deal And The Three Questions You Can't Answer

Knowledge velocity isn't an abstract concept, but the measurable difference between firms that compound institutional learning and firms that start from scratch with every deal. To understand why 85% of LPs are rejecting opportunities based on operational concerns, consider how your firm actually operates.

Think about how your firm operates today. When evaluating a new investment opportunity:

- How long does it take to surface relevant insights from similar past deals? Hours? Days? Is someone manually searching through old IC memos and email threads?

- Can your team instantly access what worked (and what failed) in comparable situations—or does that wisdom live exclusively in partners' heads?

- Does your junior talent spend days recreating analysis that's been done multiple times before, because there's no systematic way to capture and retrieve past work?

Now think about your portfolio companies:

- When key partners are unavailable, can your team deploy value creation playbooks with the same effectiveness—or does portfolio transformation slow to a crawl?

- Do you measure how quickly institutional knowledge translates into portfolio company improvements, or is "operational value creation" still more aspiration than metric?

- What happens to decades of expertise when partners retire or move on? Does that knowledge transfer systematically, or does it walk out the door?

These aren't theoretical questions. They're the operational reality that determines whether you're building compounding competitive advantage or recreating knowledge from scratch with every deal. And increasingly, they're what LPs are evaluating when they assess whether your firm can actually deliver on operational value creation promises.

Here's why this matters now: The shift from financial engineering to operational value creation means your firm's ability to systematically capture and deploy knowledge has become as important as your investment thesis. BCG quantifies this gap: representative PE funds managing $20 billion in AUM are leaving $20-30 million in annual value on the table due to knowledge management inefficiencies.

Yet most firms are still operating with knowledge trapped in partners' heads, despite having adopted AI tools. The difference between tools and infrastructure is the difference between local efficiency gains and systematic competitive advantage, and LPs can see that difference clearly.

This is what separates firms with high knowledge velocity from everyone else: the ability to answer three specific questions with metrics and proof points rather than descriptions of team experience.

The Three Questions That Kill Deals

During operational due diligence, sophisticated LPs are now asking three deceptively simple questions. Based on conversations across the industry, most GPs are stumbling badly on all three.

Question #1: "Walk me through how you leverage learnings from past deals in your current pipeline."

What LPs want to hear: "Our Organizational Intelligence Platform captures insights from every deal. When evaluating new opportunities, our team instantly accesses pattern recognition across our deal history. For example, when we looked at our healthcare IT target last week, the system automatically surfaced three comparable investments from the past four years, synthesized the key success factors and failure points, identified experts with relevant experience, and flagged risk areas we should probe based on what we learned previously. Our associates had actionable intelligence in under 30 seconds."

What most GPs actually say: "Our partners have decades of experience, and we have regular IC discussions where we share insights..."

Translation: Knowledge is trapped in partners' heads. There's no systematic capture. Junior team members spend weeks recreating analysis that's been done multiple times before. Pattern recognition happens through memory and intuition, not data.

Why this kills deals: LPs now understand that in Q4 2025's compressed timelines—with 1,607 funds approaching wind-down and record deal flow—knowledge velocity equals decision velocity equals competitive advantage. If your knowledge infrastructure hasn't scaled with your AUM, you're operating with one arm tied behind your back.

Question #2: "What happens to your portfolio value creation capability when key partners are unavailable?"

What LPs want to hear: "We've systematized institutional knowledge. Our post-acquisition playbook deploys across portfolio companies with measured 90-day results regardless of which partner leads the deal. We've documented our value creation methodology in our Organizational Intelligence Platform, so expertise is accessible to the entire team. Last quarter, when our industrial sector lead was tied up with two simultaneous exits, our associates successfully launched the Day 1-30 knowledge capture phase at a new manufacturing acquisition using our proven framework. No delays, no dependencies."

What most GPs actually say: "We have deep bench strength across the partnership..."

Translation: There are critical single points of failure. When the expert who understands European logistics deals is busy, evaluation of European logistics opportunities slows or stops. When partners retire, decades of institutional knowledge walks out the door.

Why this kills deals: BCG's research quantifies this problem: representative PE funds managing $20 billion in AUM are leaving $20-30 million in annual value on the table due to knowledge management inefficiencies. For larger institutions, that number exceeds $100 million. LPs can do this math too. They're increasingly asking: "Are we funding a firm or funding a few key individuals?"

Question #3: "How do you measure and improve your firm's knowledge velocity?"

What LPs want to hear: "We track knowledge velocity as a core operational metric alongside AUM and deal flow. We measure time-from-question-to-insight, expert dependency rates, and knowledge contribution rates. Last quarter, we reduced investment analysis time by 50% compared to two years ago—not by working harder, but by building systems that make institutional knowledge instantly accessible. We can show you our dashboard."

What most GPs actually say: "We're implementing AI tools to improve efficiency..."

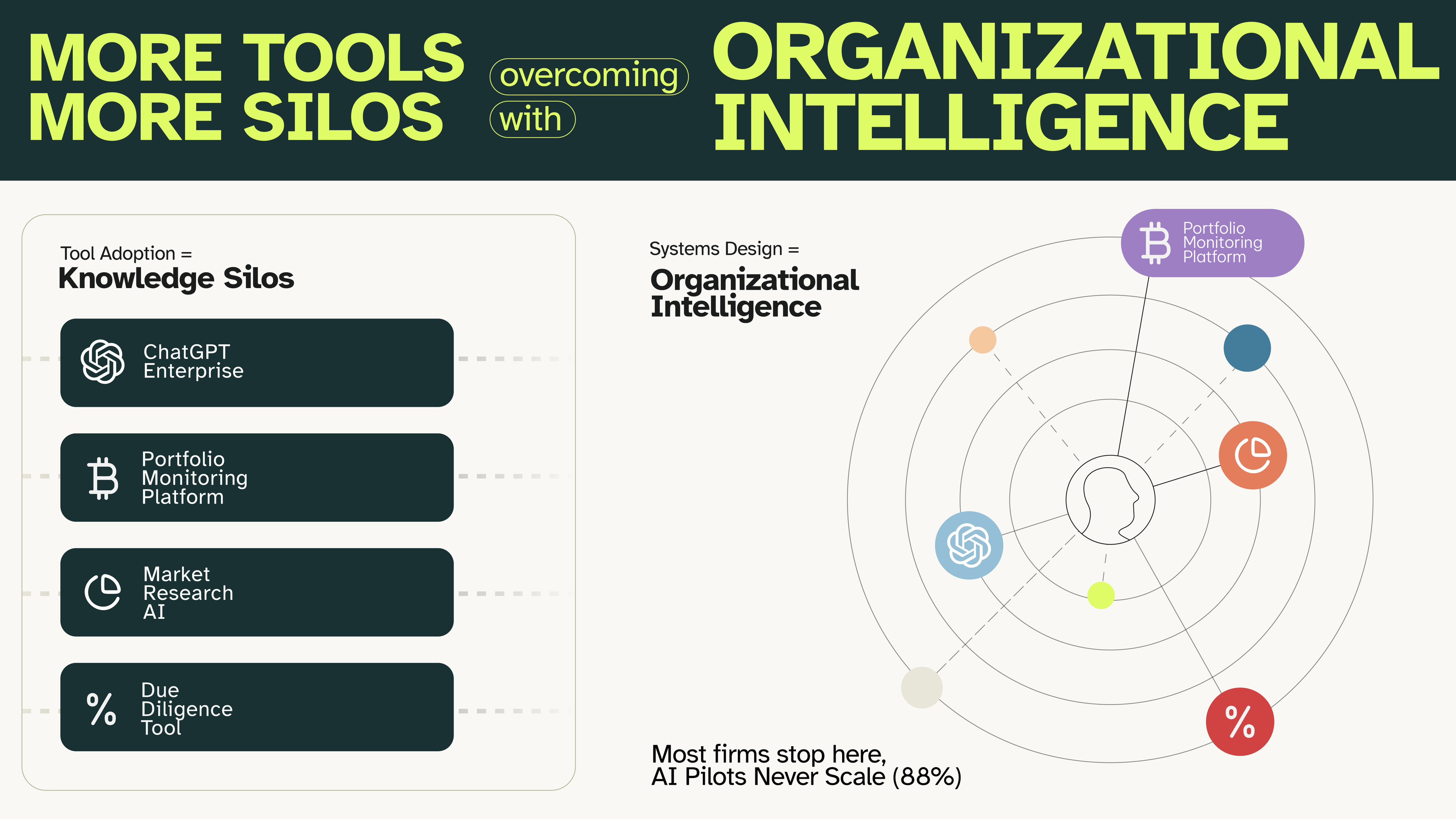

Translation: We bought ChatGPT Enterprise and a few other point solutions. Different teams use different tools. We're generating local efficiency gains but fragmenting knowledge across disconnected systems. We don't actually measure knowledge velocity because we don't think of it as a measurable competitive advantage.

Why this kills deals: LPs have learned from watching the broader enterprise AI adoption disaster unfold. Recent data shows 42% of companies scrapped most of their AI initiatives in 2025, up sharply from 17% the year before. Harvard Business Review's September 2025 research found that 70% of AI initiatives fail specifically due to siloed implementations.

LPs are asking: "Are you building organizational intelligence or just buying disconnected AI tools?"

The Brutal Reality: You're Competing Against Different Operating Systems

Here's what's creating the competitive divide that LPs can see but many GPs can't:

Vista Equity Partners requires all 85+ portfolio companies to submit quantified gen AI goals and tracks 30% productivity increases systematically. Apollo Global Management established Centers of Excellence with external AI expert advisory boards and generates 40% cost reductions with measurable ROI. Hg Capital uses systematic pattern recognition to identify previously unnoticed investment patterns—like specific customer concentration profiles combined with contract structures that predict outperformance.

These firms aren't just using AI tools. They're building organizational intelligence platforms that capture learning from every deal and scale insights systematically. Each deal makes them smarter for the next one. Each pattern gets applied across their entire portfolio.

And here's the kicker: They're demonstrating this capability to LPs during due diligence. When LPs ask the three killer questions, Vista, Apollo, and Hg can answer with specifics, metrics, and proof points.

They're not competing with you on traditional metrics anymore. They're competing with different operating systems.

Why Your AI Tools Aren't Saving You

If you're thinking "But we're adopting AI! We have tools!" you're missing the point entirely.

A Writer.com 2025 survey delivered devastating findings:

- 42% of C-suite executives report AI adoption is "tearing their companies apart"

- 72% of executives say their companies develop AI applications in silos

- 68% report AI created tension between IT and other business areas

- 88% of AI pilots never make it to production (IDC)

At the Fortune Most Powerful Women Summit in October 2025, executives from Microsoft, Bloomberg Beta, and AI startups discussed the MIT study showing 95% of enterprise AI pilots fail to pay off. The consensus? Most organizations are approaching AI adoption completely wrong.

The problem isn't the technology. The problem is treating AI as a collection of productivity tools rather than building organizational intelligence infrastructure.

When you buy ChatGPT Enterprise for IC memo writing, another tool for deal sourcing, another for portfolio monitoring, and another for market research, you've simply moved your knowledge silos from email and shared drives into disconnected AI systems. You're optimizing discrete tasks while fragmenting institutional knowledge.

Richard Lichtenstein, Partner and Chief Data Officer for Private Equity at Bain & Company, stated in a recent webinar: "Knowledge management is the [Gen AI] category that's by far the most mature." But he's talking about knowledge management as organizational intelligence—not just better search tools.

The Question LPs Are Really Asking: "Do You Operate As Intelligently As You Invest?"

Here's the uncomfortable insight that's reshaping LP evaluation criteria:

Fund-level operational sophistication predicts portfolio-level value creation capability.

Think about it from an LP's perspective. You're evaluating two funds with similar track records and investment theses:

Fund A demonstrates during due diligence that:

- Knowledge is trapped in partners' heads

- Junior team members spend weeks doing knowledge archaeology

- Deal evaluation recreates past analysis multiple times

- Post-investment reviews exist but insights aren't systematically captured

- AI tools are being adopted in disconnected ways

Fund B demonstrates during due diligence that:

- Institutional knowledge is systematically captured and instantly accessible

- Investment analysis time decreased 50% over two years through better systems

- Pattern recognition happens automatically across deal history

- Post-acquisition playbook deploys consistently with measured results

- AI powers an integrated Organizational Intelligence Platform

Which fund do you think can actually transform portfolio company operations?

LPs are making this connection explicitly now. IPEM Paris 2025 emphasized that roughly half of PE value creation now comes from operational improvements rather than financial engineering. If a GP can't demonstrate operational excellence in their own firm, why would LPs believe their portfolio transformation promises?

What "AI-Native Operations" Actually Means

The phrase "AI-native" is being thrown around carelessly in fundraising decks. Here's the real definition:

AI-native operations means intelligence is embedded from day one—systems designed where knowledge capture, synthesis, and dissemination happen automatically as part of core workflows.

AI tools adoption means retrofitting existing processes with productivity tools—buying solutions that optimize discrete tasks without changing how the organization learns and improves.

The difference shows up in three ways:

- Knowledge Capture

- AI Tools: Partners manually document insights in shared drives or wikis when they remember

- AI-Native: Every IC decision, due diligence finding, and portfolio board insight captured systematically with context, not just content

- Pattern Recognition

- AI Tools: Partners notice patterns through memory and experience

- AI-Native: Systems automatically identify patterns across investments—like Hg discovering that specific customer concentration + contract structures predict outperformance

- Institutional Memory

- AI Tools: Junior associates spend days searching for and synthesizing past work

- AI-Native: 50% reduction in investment analysis time because systems proactively surface relevant institutional knowledge

Microsoft's Amy Coleman said at the Fortune summit: "You have to be okay with failure. You have to be okay with messy. We're talking about the entry point of this transformation."

The Path Forward: What LPs Actually Want to See

If you're a GP reading this and feeling defensive, good. That discomfort is the gap between where you think you are operationally and where LPs now expect you to be.

Here's what demonstrating operational sophistication actually looks like in 2025:

During your next LP due diligence meeting:

Instead of talking about your team's experience, show your knowledge velocity metrics. "Our time-from-question-to-insight decreased from 8-15 hours to under 5 minutes over the past 18 months. Here's our dashboard."

Instead of describing your AI tool stack, explain your Organizational Intelligence Platform. "Every deal flows through our system. Every portfolio board meeting captures insights. Every interaction with sector experts documents knowledge with full context. We don't just use AI tools—we've built AI-native operations."

Instead of promising portfolio transformation, demonstrate fund-level mastery. "Let me walk you through how we systematically capture and deploy institutional knowledge. This same methodology becomes our 90-day playbook for portfolio companies. We're not theorizing about operational excellence; we operate with it daily."

The firms winning LP commitments in Q4 2025 are the ones who've realized something fundamental: Operational due diligence isn't a checklist to satisfy. It's an opportunity to demonstrate competitive advantage.

The Q1 2026 Reality: Two Types of Firms Will Emerge

Look ahead six months, and the private equity landscape will have bifurcated decisively:

AI-Native Firms will be characterized by:

- Knowledge velocity as measured competitive advantage

- Organizational Intelligence Platforms as core infrastructure

- Systematic portfolio transformation capability with proven metrics

- Ability to answer the three killer LP questions with specifics

- Fundraising advantage through demonstrated operational sophistication

Traditional Firms will struggle with:

- Knowledge trapped in experts' heads despite having AI tools

- Point-solution proliferation creating new coordination costs

- Each deal starting from scratch despite decades of experience

- Inability to quantify operational sophistication

- Increasing LP scrutiny revealing systematic gaps

The divide isn't about who works harder or has better judgment. It's about operating systems.

And here's the most critical insight: This gap compounds. Firms with organizational intelligence get smarter with every deal. Their pattern recognition improves. Their junior team members become productive faster. Their portfolio transformations get more systematic. They're creating compounding advantages while others optimize discrete tasks.

The Question You Need to Ask Yourself

You're probably making decisions right now about Q1 2026 fundraising, portfolio company priorities, and team investments. Before you finalize those plans, ask yourself one question:

If an LP walked into your next board meeting and asked you to demonstrate—not describe, but actually show—how your firm systematically captures, synthesizes, and deploys institutional knowledge across deals and portfolio companies, what would you pull up on screen?

If your answer is "our team has decades of collective experience" or "we're implementing AI tools," you're already in the 85% that LPs are rejecting.

The operational due diligence conversation has fundamentally changed. The question is whether you've changed with it.

About Salfati Group: We specialize in Organizational Intelligence Platforms that transform how PE/VC firms and portfolio companies capture, synthesize, and deploy knowledge at scale. Our Sentient Software™ approach turns disconnected AI tools into unified intelligence systems—so you can answer the three questions LPs are asking with confidence, metrics, and proof.

Ready to assess where your firm stands? Download “The $100M Opportunity: Why Organizational Intelligence Is the Next Value Frontier for PE and VC Funds” Whitepaper.